Kam Financial & Realty, Inc. Fundamentals Explained

Kam Financial & Realty, Inc. Fundamentals Explained

Blog Article

Not known Details About Kam Financial & Realty, Inc.

Table of ContentsWhat Does Kam Financial & Realty, Inc. Mean?Facts About Kam Financial & Realty, Inc. UncoveredThe Main Principles Of Kam Financial & Realty, Inc. The smart Trick of Kam Financial & Realty, Inc. That Nobody is Talking AboutFascination About Kam Financial & Realty, Inc.Kam Financial & Realty, Inc. Things To Know Before You Get This

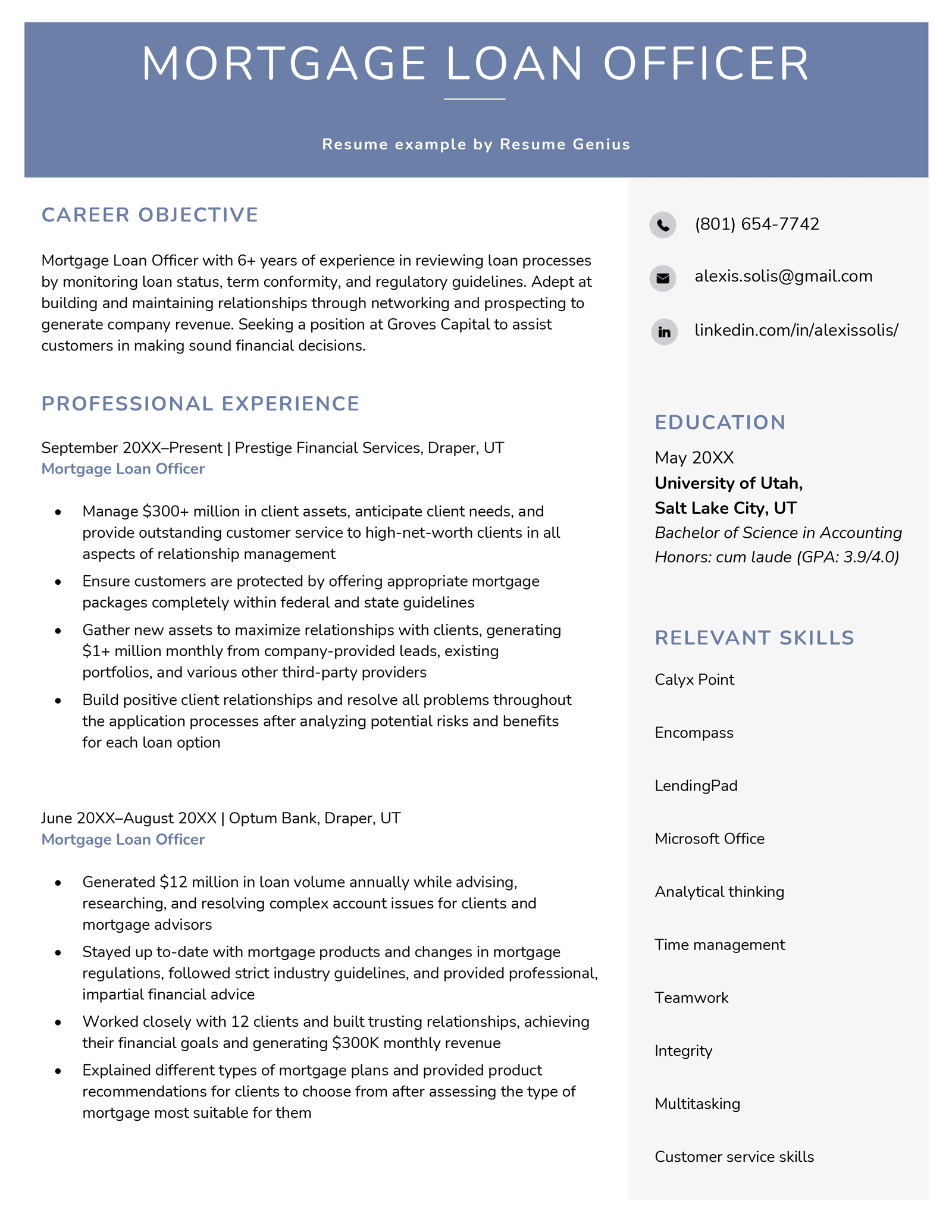

A home loan is a financing utilized to buy or maintain a home, plot of land, or other genuine estate.Home mortgage applications undertake a rigorous underwriting process prior to they get to the closing phase. The building itself offers as security for the car loan.

The price of a home mortgage will certainly depend upon the kind of financing, the term (such as thirty years), and the rates of interest that the lender fees. Home mortgage prices can differ extensively relying on the type of product and the certifications of the applicant. Zoe Hansen/ Investopedia People and businesses make use of home loans to copyright estate without paying the entire acquisition cost upfront.

Kam Financial & Realty, Inc. Fundamentals Explained

Many conventional home loans are completely amortized. Typical home mortgage terms are for 15 or 30 years.

A domestic homebuyer pledges their residence to their lender, which then has a case on the building. In the situation of foreclosure, the lending institution may evict the citizens, offer the building, and use the money from the sale to pay off the home mortgage financial obligation.

The lender will certainly request proof that the customer is capable of paying off the financing. This might include financial institution and financial investment declarations, current tax obligation returns, and proof of existing employment. The lending institution will typically run a credit report check . If the application is approved, the lender will provide the customer a loan of as much as a certain amount and at a specific rate of interest.

Little Known Facts About Kam Financial & Realty, Inc..

Being pre-approved for a home mortgage can provide purchasers an edge in a tight real estate market since vendors will certainly know that they have the cash to back up their deal. Once a buyer and vendor settle on the regards to their deal, they or their agents will meet at what's called a closing.

The vendor will certainly transfer ownership of the home to the purchaser and obtain the agreed-upon sum of money, and the buyer will sign any type of staying home mortgage files. The lending institution might bill fees for coming from the lending (occasionally in the kind of points) at the closing. There are thousands of options on where you can obtain a home loan.

A Biased View of Kam Financial & Realty, Inc.

The conventional type of mortgage is fixed-rate. A fixed-rate mortgage is likewise called a standard mortgage.

What Does Kam Financial & Realty, Inc. Do?

The entire car loan equilibrium ends up being due when the customer dies, moves away completely, or sells the home. Factors are basically a cost that consumers pay up front to have a reduced interest price over the life of their car loan.

Kam Financial & Realty, Inc. Fundamentals Explained

How a lot you'll have to pay for a home loan depends upon the kind (such as dealt with or adjustable), its term (such as 20 or 30 years), any price cut factors paid, and the rate of interest at the time. mortgage loan officer california. Rate of interest can differ from week to week and from lender to lending institution, so it pays to look around

If you default and seize on your home loan, however, the bank might become the new proprietor of your home. The rate of a home is usually much higher than the quantity of cash that the majority of homes conserve. Because of this, home loans permit people and households to purchase a home by taking down only a reasonably tiny down settlement, such as 20% of the purchase price, and acquiring a car loan for the equilibrium.

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg)

Report this page